As not-for-profit financial cooperatives, credit unions aim to provide their members with exceptional service and valuable financial products. In today’s digital age, offering helpful and responsive member support through live chat has become an essential part of achieving that goal.

Integrating user-friendly live chat software can enable credit union employees to deliver prompt assistance to members, whether they are applying for a loan, checking their account balances, or have general inquiries.

This article explores the key features credit unions should look for when choosing live chat software for their websites. We compare the top solutions in terms of integration options, customizability, analytics capabilities, and compliance standards. By opting for feature-rich live chat tailored to the credit union industry, financial institutions can enhance online member experiences and provide support whenever and wherever members need it.

The right live chat system facilitates more productive online interactions between staff and members, reflecting credit unions’ focus on people-first financial relationships. Read on for our pick of the best live chat software for credit unions looking to take their member service into the digital era.

6 Best Live Chat Software for Credit Union at a glance

| Software | Pricing | Key Features for Startups |

|---|---|---|

| ThriveDesk | Starts at $25/month | Easy to use, mobile-friendly, secure |

| Podium Webchat | Starts at $399/ month | Multi-channel communication, text-based chat, canned responses |

| LivePerson | Pay as you go | Conversational AI, omnichannel messaging, agent tools |

| Bold360 | Starts at $20,000/year | AI-powered chatbots, omnichannel availability, smart routing |

| LiveChat | Starts at $20 per agent/month | Omnichannel, chatbots & automation, secure infrastructure |

| Glia | Custom pricing | DCS platform, blends AI with live support, visual engagement tools |

6 Best Live Chat Software for Credit Union In Depth

ThriveDesk

ThriveDesk is an intuitive, affordable yet robust live chat platform tailored to boosting member satisfaction through enhanced digital support. With ThriveDesk, credit unions can facilitate convenient member conversations across websites and mobile channels, enabled by tools like chatbots, skills-based routing, and built-in analytics.

With robust collaboration tools, deep integrations, and insightful analytics, ThriveDesk empowers your staff to deliver instant, personalized support around the clock. Chatbots and mobile apps help drive 24/7 assisted service.

ThriveDesk is engineered with strong security foundations, including strict access controls, infrastructure hardening encryption.

Key features of ThriveDesk:

- Easy to Use: Intuitive interface simplifies adoption for both staff and members.

- Mobile Compatibility: Members can reach your credit union conveniently on the go, from any mobile device.

- Shared Inbox and Collaboration Tools: Facilitate efficient teamwork between departments, allowing swift responses and seamless information sharing.

- Multiple Agent Logins: Ensure prompt assistance by allowing multiple credit union representatives to handle chat inquiries simultaneously.

- Real-Time Translation: Break down language barriers and provide inclusive member support.

- Customizable Chat Widget: Tailor the chat experience to reflect your credit union’s brand identity.

- Canned Responses: Pre-defined and customizable responses for frequent inquiries save time and ensure consistent, accurate information sharing.

- Knowledge Base Integration: Empower members to self-serve by providing instant access to relevant articles and resources directly within the chat window.

- Chat + Email: Maintain consistent member engagement by seamlessly transitioning from live chat to email.

- AI-powered Features: Leverage AI to automate routine tasks, suggest appropriate responses, and facilitate faster problem-solving, improving overall support efficiency and member satisfaction.

- Notifications: Keep credit union staff and agents informed with real-time alerts, guaranteeing timely responses and efficient collaboration on member inquiries.

- Lightweight and High Performance: ThriveDesk operates smoothly and maintains optimal website performance without impacting search engine rankings.

- Secure Infrastructure: Leverage robust security measures, including the latest encryption protocols, server protections, and strict access controls, to safeguard member data and ensure compliance with industry regulations.

- Scalability: ThriveDesk adapts effortlessly as your credit union grows, accommodating a rising number of members and increasing communication demands.

- Cost-Effective: ThriveDesk offers a budget-friendly solution compared to some specialized credit union live chat platforms.

| Pros | Cons |

|---|---|

| Intuitive interface and collaboration features facilitate exceptional member service | Lacks video/voice chat |

| Mobile capabilities provide members with convenient on-the-go assistance | Additional custom coding could be required for optimal website integration |

| AI-powered tools increase chat efficiency and issue resolution | |

| Robust security protects sensitive member information | |

| Highly customizable to match credit union branding needs | |

| Cost-effective compared to some niche industry platforms |

ThirveDesk Pricing:

| Starter | $25/month (4 seats) |

| Plus | $49/month (10 seats) |

ThriveDesk’s pricing plans are fair and competitive. The company offers a variety of plans to suit the needs of businesses of all sizes

With robust live chat capabilities, omnichannel integrations, and customization options, ThriveDesk enables credit unions to deliver exceptional real-time support, nurture client relationships and facilitate a smooth post-service experience – ultimately driving growth through improved resolution and loyalty.

Podium Webchat

Podium stands out as an intelligent live chat and messaging platform designed specifically for financial institutions like credit unions that aim to provide exceptional member service. Integrated directly into your website and mobile banking apps, Podium enables personalized chatbot or live agent support so members can get prompt assistance with anything from checking account balances to applying for loans

Key features of Podium Webchat:

- Multi-Channel Communication: This allows credit unions to communicate with members through various channels like SMS, email, and social media besides live chat, offering flexibility and convenience.

- Chat/Messaging: This enables credit unions to have asynchronous communication with members, allowing them to respond at their own pace.

- Text-based communication: Live chats are converted into text threads to provide a familiar and convenient way for customers to interact, potentially appealing to a wider audience.

- Canned Responses: This allows credit unions to quickly respond to frequent questions and inquiries, saving time and ensuring consistency.

- Automated Routing: This helps route chat inquiries to the most appropriate agent based on factors like expertise or availability, streamlining the process.

- Activity Tracking: This provides credit unions with insights into member interactions and engagement, allowing them to improve their service quality.

- Real-Time Notifications: This ensures credit unions receive alerts when a member starts a chat or sends a message, enabling them to respond promptly.

- Compliance Management: This helps credit unions meet industry regulations and ensure the security of member data.

- Security Features: This includes features like data encryption and PCI compliance to safeguard member information.

- Reporting & Analytics: This gives credit unions valuable insights into member interactions and helps them track and improve their live chat performance.

| Pros | Cons |

|---|---|

| Provides real-time communication for faster resolution of inquiries, enhancing customer satisfaction | Can be expensive compared to some standalone webchat solutions, especially for smaller businesses |

| Reduces reliance on phone calls and emails, streamlining communication and agent workload | Customization options for chat interface and functionality might be limited compared to some competitors |

| Allows interaction through various channels like SMS and email alongside webchat, offering flexibility for customers | May require technical expertise or support for seamless integration with existing systems |

| Saves time and resources with features like canned responses, automated routing, and proactive chat | The platform prioritizes review generation and management, which might not be the primary focus for all businesses |

| Ensures customers speak with real representatives, fostering trust and personalized service | |

| Offers secure communication and data encryption to protect sensitive information |

Podium Pricing:

| Core | $399/month |

| Pro | $599/month |

| Signature | Custom pricing |

LivePerson

LivePerson is an industry-leading conversational AI platform designed to transform digital banking experiences. Its specialized financial services solution facilitates automated yet personalized support across channels, helping credit unions boost efficiency, security, and trust.

Key features of LivePerson:

- Conversational Bots: Automate common member inquiries like billing, fraud prevention, and account requests, freeing up staff for more complex issues.

- Omnichannel Messaging: Provide seamless support across various communication channels, including web chat, mobile apps, and popular messaging platforms like Facebook Messenger, for convenient member engagement.

- Agent Tools: Equip your team with powerful tools to efficiently guide conversations and facilitate personalized member interactions.

- Advanced Fraud Detection: Identify and prioritize potential security threats, ensuring the protection of member accounts and financial information.

- Lending Assistance: Streamline the loan application process by offering automated guidance and pre-qualification options to your members.

- Promotions Engine: Utilize AI to deliver personalized offers and discounts based on individual member needs and preferences, enhancing engagement and loyalty.

- Comprehensive Analytics: Gain valuable insights into member conversations and interactions, allowing you to track performance, identify trends, and continuously improve your service offerings.

| Pros | Cons |

|---|---|

| Designed specifically for the unique needs of the financial services industry, ensuring features and functionalities are directly relevant to credit unions | Configuring automated workflows and utilizing AI-powered tools might require initial investment in training and familiarization for staff |

| Easily adapts to handle growing member traffic, ensuring consistent and efficient service during peak periods | Accessing the full suite of AI agent tools might involve additional costs beyond the base platform fee |

| Automates repetitive tasks, reducing call volume and freeing up agent time to focus on complex member interactions | Integrating LivePerson with existing systems and customizing branding options might require additional technical expertise or third-party services compared to some general chat solutions |

| Provides credit unions with the tools to proactively engage members and enhance their overall digital banking experience | |

| Offers a secure platform with robust fraud detection capabilities to safeguard member data and financial information | |

| Enables personalized and trustworthy interactions between credit unions and their members through AI-powered assistance |

LivePerson Pricing:

LivePerson offers a pay as you go model of pricing so you need to contact their sales team to get a quote.

Bold360

Bold360 is an AI-powered customer engagement platform designed specifically for credit unions. This platform blends advanced conversational AI with human-centric support, offering a personalized digital banking experience across all member touchpoints. Bold360 empowers credit unions to free up valuable agent time, boost omnichannel engagement, and ensure effortless member service.

Key features of Bold360:

- Intelligent Chatbots: 24/7 automated assistants powered by natural language processing (NLP) understand member inquiries, providing faster issue resolution while freeing up agents for more complex matters.

- Omnichannel Availability: Seamless support across web chat, mobile apps, and popular messaging applications, providing members with convenient access to assistance on their preferred communication channel.

- Smart Routing: Leverage AI to intelligently route member inquiries to the most appropriate agent based on their expertise and the nature of the issue, ensuring quick and efficient resolution.

- Co-browsing: Securely collaborate with members in real-time by viewing and guiding them through online processes, enhancing understanding and resolving issues swiftly.

- CRM Integrations: Access complete member profiles within the chat interface, allowing agents to personalize interactions and provide informed service based on individual needs and history.

| Pros | Cons |

|---|---|

| Intelligent chatbots handle frequent inquiries, freeing up agents to focus on complex issues and member relationship building | Compared to general chat platforms, Bold360 might involve higher initial or ongoing costs |

| Caters to members’ preferred communication styles across various channels, boosting engagement and accessibility | Integrating with existing systems might require custom development in some cases, adding complexity and potential costs |

| Leverages AI to streamline operations, personalize interactions, and improve efficiency at scale | Some user reviews report mixed experiences with vendor customer service responsiveness |

| Built-in features and functionalities facilitate compliance with security and data protection regulations, reducing administrative burden | The interface might offer less customization compared to other chat solutions |

| Analyze chat volume, satisfaction scores, and agent activity for actionable insights | |

| Offers a centralized platform for managing all member interactions and gaining valuable insights to optimize support operations |

Bold360 Pricing:

Bold360 typically costs between $60,000 and $100,000 per year to implement, with some reduced plans starting at $20,000 annually. It is unquestionably one of the more expensive live chat and customer service chatbot options.

LiveChat

LiveChat is an intuitive and versatile omnichannel platform designed to enhance digital member engagement for financial institutions like credit unions. It allows you to facilitate seamless conversations with members across their preferred channels, including websites, apps, and popular messaging applications, ensuring responsive and efficient member support.

Key features of LiveChat:

- Omnichannel Accessibility: Equip members with the flexibility to connect with you through web chat, SMS, and popular messaging platforms like Facebook Messenger, fostering convenient and familiar communication pathways.

- Chatbots and Automation: Leverage intelligent chatbots to handle common member inquiries and automate routine tasks, freeing up your agents to focus on complex issues and personalized interactions. This leads to improved efficiency and a better return on investment (ROI).

- Real-Time Data and Proactive Engagement: Gain valuable real-time insights into member behavior and online activity. Utilize this data to proactively identify members who might require assistance, addressing their needs before they escalate and enhancing the overall member experience.

- Secure Infrastructure and Compliance: LiveChat offers a secure platform that adheres to the highest compliance standards for data protection, ensuring the privacy and security of sensitive member information. This helps you stay compliant with relevant financial regulations.

- Integration Hub and Streamlined Operations: Connect your LiveChat platform seamlessly with your existing systems and applications using the integration hub, allowing for smooth data flow and streamlined workflows.

- Team Collaboration Tools: Improve your team’s chat efficiency with features like canned responses, file sharing, and agent transfer capabilities, ensuring prompt and consistent member service.

| Pros | Cons |

|---|---|

| LiveChat offers specialized templates and features specifically designed to cater to the unique needs of the financial services industry, ensuring a solution that aligns with your requirements | LiveChat might require more custom development efforts to fully integrate with your specific systems and workflow |

| The omnichannel accessibility empowers members to connect with you on their preferred platforms, leading to increased digital engagement and improved member satisfaction | Accessing the fullest range of automation features might involve additional fees beyond the base platform subscription |

| Utilizing chatbots and automation reduces call volume and streamlines routine tasks, freeing up your agents to focus on higher-value interactions and ultimately enhancing your return on investment | While intuitive, LiveChat might necessitate a slightly steeper learning curve compared to basic live chat tools for some users, especially those unfamiliar with advanced features like automation and integrations |

| LiveChat’s robust security measures and commitment to compliance standards offer peace of mind and help you stay compliant with relevant regulations | |

| Gain valuable insights and analytics from member interactions, allowing you to continuously optimize your chat performance and tailor your strategies for maximum effectiveness |

LiveChat Pricing:

| Starter | $20 per agent/month, billed annually |

| Team | $41 per agent/month, billed annually |

| Business | $59 per agent/month, billed annually |

| Enterprise | Custom pricing |

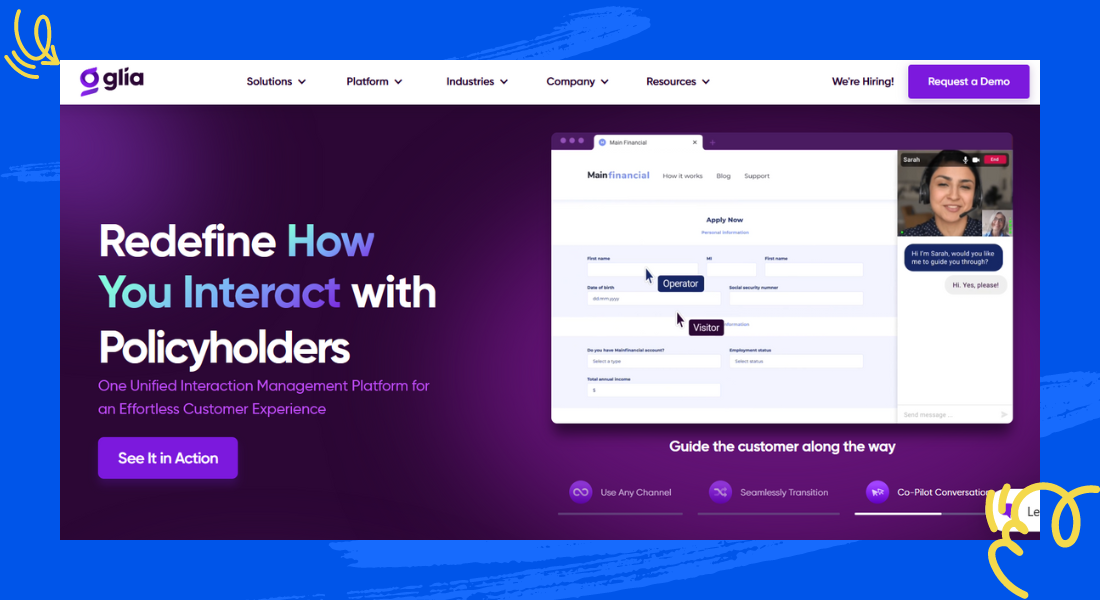

Glia

Glia offers a comprehensive Digital Customer Service (DCS) platform designed to revolutionize member experiences in your credit union. They seamlessly blend advanced AI assistance with powerful live online banking support tools, including chat, video, co-browsing, and more, empowering your team to deliver exceptional service across all member touchpoints.

Key features of Glia:

- Omnichannel Support: Glia caters to diverse member preferences by offering multiple communication options, including chat, SMS, video calls, voice calls, and co-browsing. This ensures members can easily connect with your team on their preferred channel, fostering convenience and accessibility.

- 24/7 AI Chatbots: Leverage intelligent chatbots to provide instantaneous self-service to members for common inquiries. This frees up your agents to focus on complex issues and personalized interactions, improving overall efficiency.

- Visual Engagement Tools: Utilize innovative visual engagement tools like co-browsing to guide members through online processes in real-time. This enhances understanding, simplifies complex tasks, and increases member satisfaction.

- Secure File Sharing: Secure file sharing enables agents and members to safely and seamlessly exchange documents during live service sessions. This eliminates the need for insecure methods like email attachments or public cloud storage services.

- Auto-Fill Messages: Auto-fill messages is a feature that intelligently suggests and pre-populates responses as agents type. This leverages machine learning to predict the most relevant and accurate responses based on the conversation context.

- Collaboration Hub: Glia fosters seamless team collaboration by providing a centralized hub where agents can easily connect with remote experts for specialized assistance, ensuring members receive the best possible support regardless of the issue.

- Cross-Channel Support: Maintain consistent and contextual member interactions across all touchpoints, whether through the web, mobile app, or even in-branch. This seamless experience streamlines communication and builds stronger member relationships.

- Conversion Analytics: Gain reports and insights into the effectiveness of your digital experience by leveraging Glia’s conversion analytics. This data allows you to identify areas for improvement and optimize your digital channel strategies for maximum impact.

| Pros | Cons |

|---|---|

| Glia’s omnichannel capabilities and visual engagement tools allow you to replicate the personalized service of a branch environment within the digital realm, leading to increased member satisfaction and loyalty | While offering sales support tools, Glia’s core focus leans more towards enhancing service experiences rather than driving direct sales conversions |

| Co-browsing empowers agents to collaboratively navigate complex tasks with members, enhancing understanding, resolving issues faster, and ultimately boosting member retention | While offered, Glia’s video and voice call functionalities are still under development and might not be as robust as some competitors |

| Utilize Glia’s guided selling tools to simplify loan and product applications, encouraging online conversions and improving overall sales efficiency | Centralizing all support data and workflows might require additional integration efforts with existing systems |

| Glia offers a centralized platform for managing all support interactions and data, reducing complexity and streamlining workflows. This fosters efficient collaboration and empowers agents to deliver exceptional service | Configuring and customizing AI workflows can involve a steeper learning curve for initial setup and ongoing management |

| Glia’s analytics capabilities provide measurable data on the impact of your digital customer service efforts. This allows you to track progress, optimize strategies, and continuously improve member experiences | The transition between bot interactions and live agent handoffs may require further refinement to ensure a smooth and seamless experience for members |

Glia Pricing:

Glia has custom pricing. Contact Glias sales team to get a quote.

Choosing the Right Live Chat for Credit Union

With a shared focus on exceptional service, credit unions need live chat software that facilitates responsive, personalized digital support. After reviewing top solutions, ThriveDesk emerges as an optimal match.

Purpose-built features like compliance protections, skills-based routing, and omnichannel access align with credit unions’ priorities – from security to relationships. Intuitive agent tools also streamline member collaboration across departments.

Though platforms like LiveChat and Glia offer robust capabilities, ThriveDesk provides an ideal balance of usability, automation, and financial customization. As rising engagement moves online, its tailored approach empowers more meaningful member connections.

By blending essential security with member-centric tools, ThriveDesk delivers the key ingredients for elevated digital banking. Its security foundations and intuitive interface help credit unions transform member relationships in the digital age.