Gen AI-powered platform to support, engage, and retain your customers

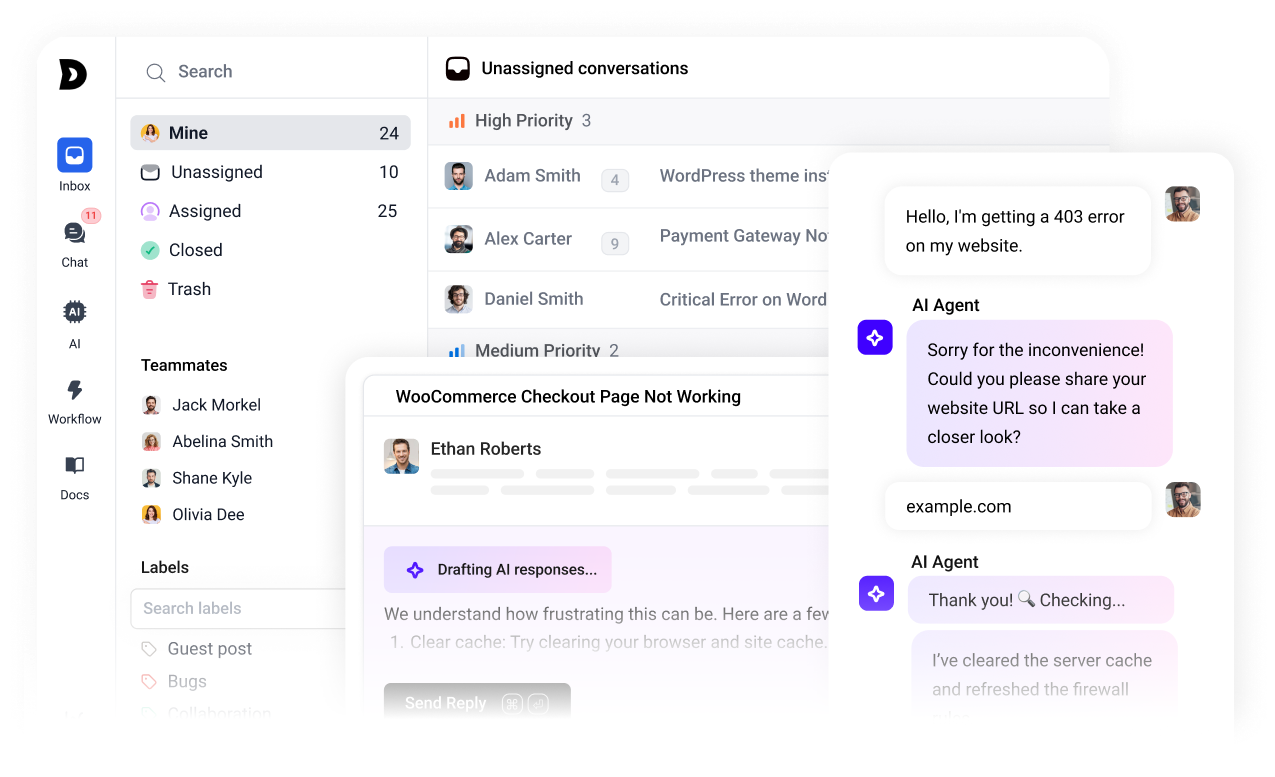

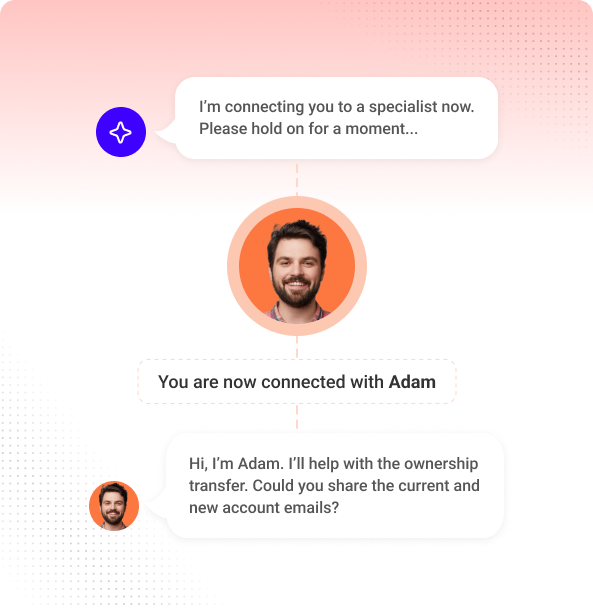

AI agents that makes customer support effortless

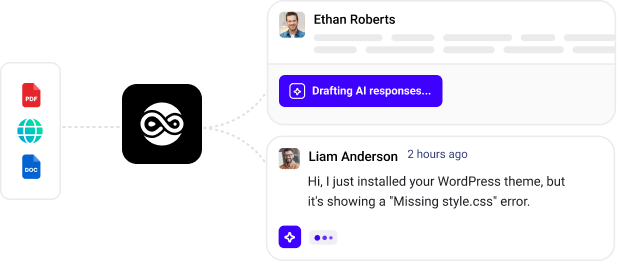

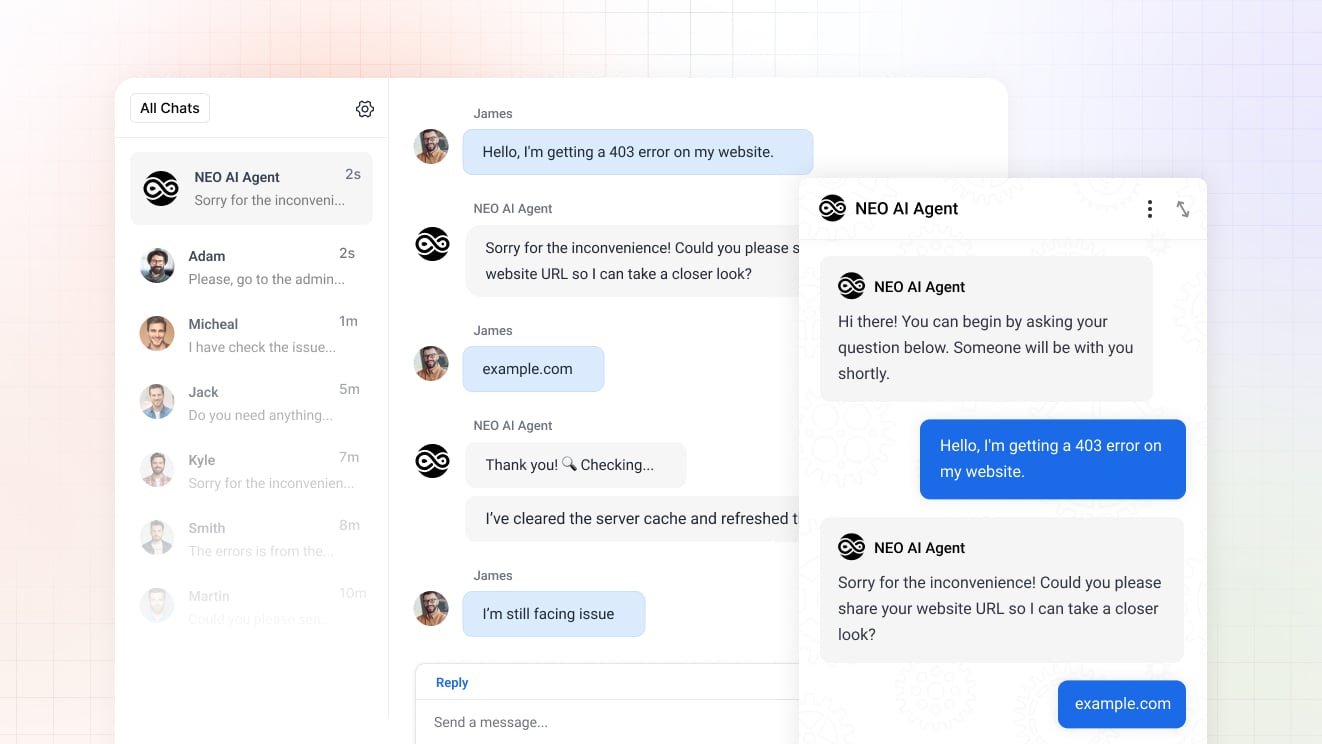

NEO AI Agent

Next-gen helpdesk

Purpose-built for LLMs

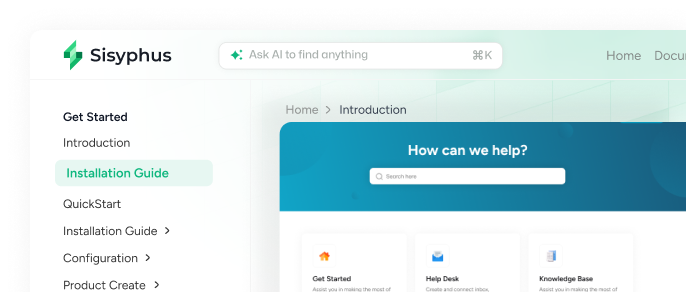

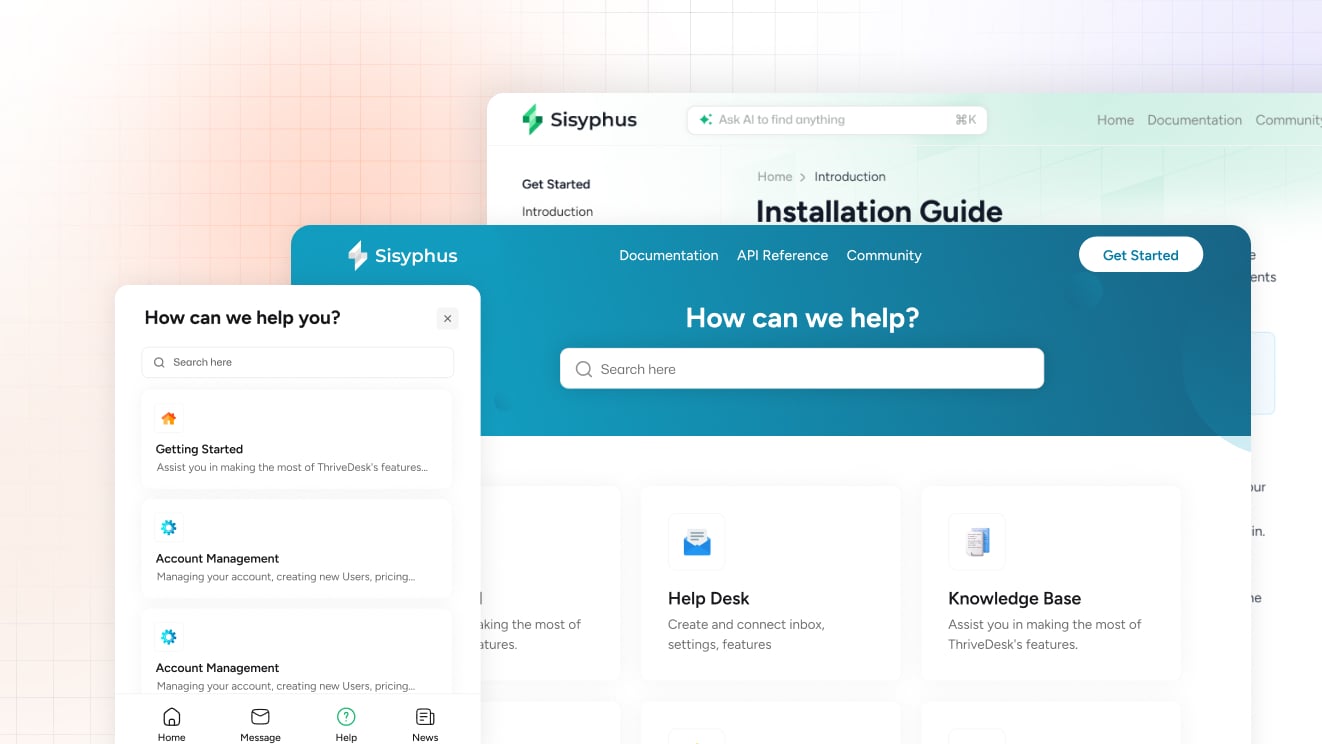

Modern help center

End-to-end AI solution for conversational support

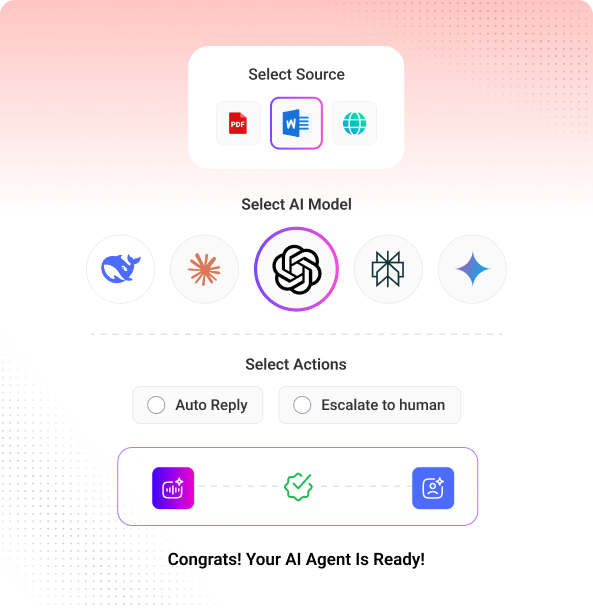

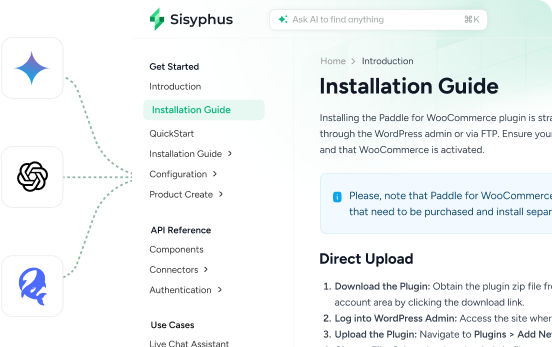

Your business knowledge, turned into instant customer answers

Train on Knowledge Base

Train on using previous conversion

Train on using PDF

Train on Webpages

Train on using Snippets

Train on using Notion docs

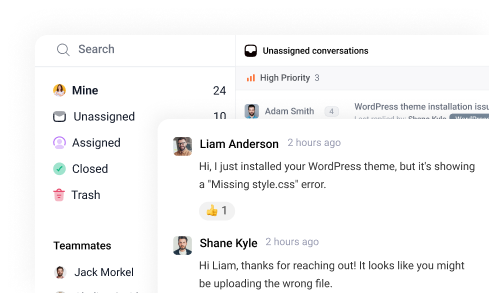

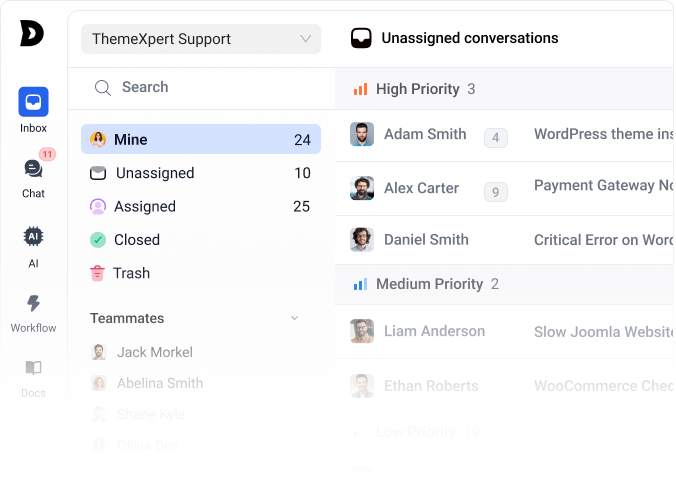

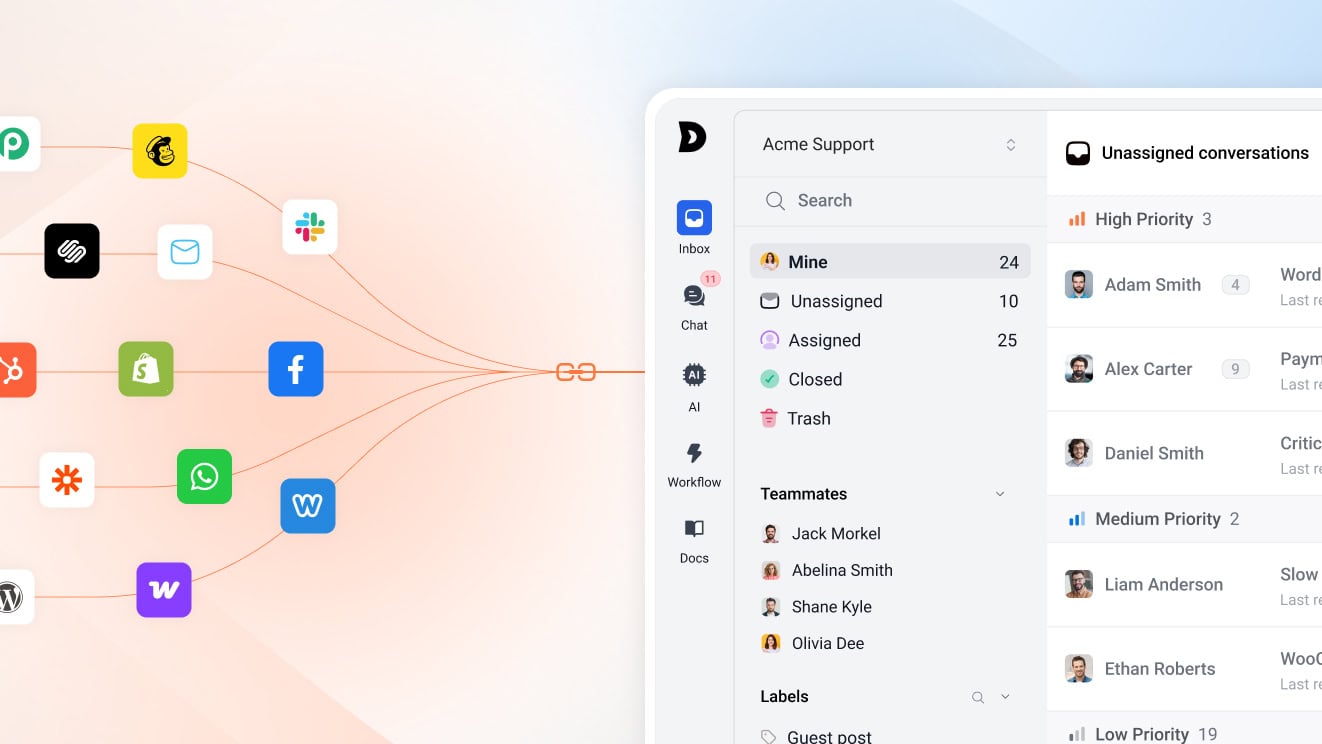

AI Helpdesk built for speed, clarity, and growth

Your team stays in the loop

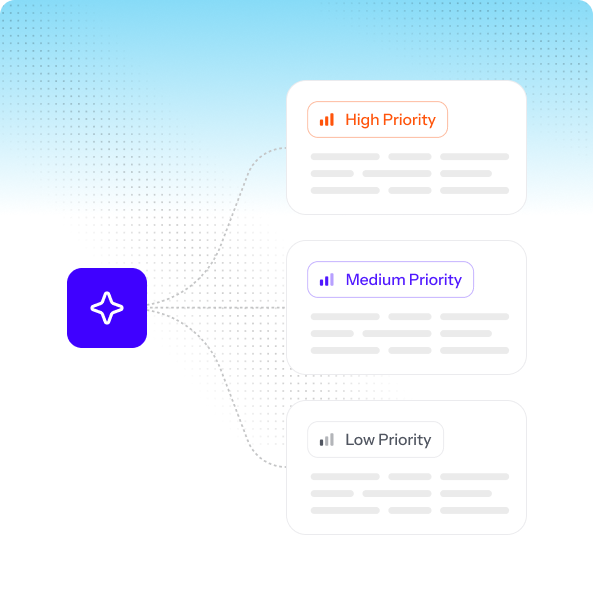

Prioritize with ease

Multiple Inboxes

Enterprise-Grade Security and Privacy

Your Data Stay Yours

Data Encryption

Secure Integrations

All the features your team needs

Upgrade your email management

Collaborate with ease

Organize your inbox

Automate for efficiency

Personalize conversations

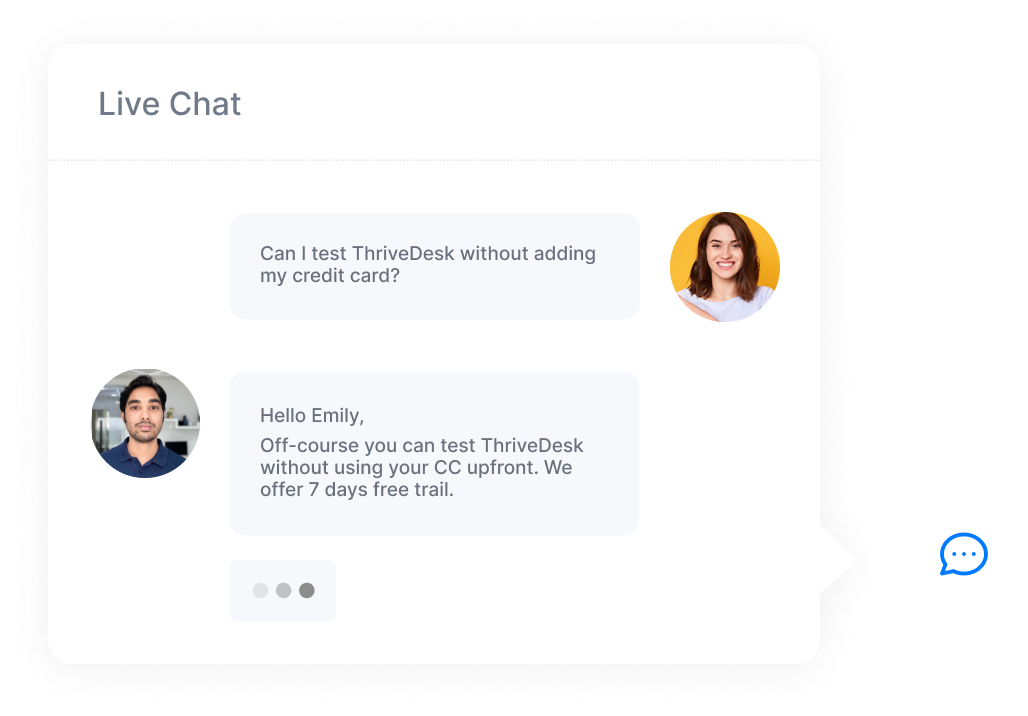

Help customer in real-time

Start in minutes

Work together live

Chat on your terms

Know who you’re talking to

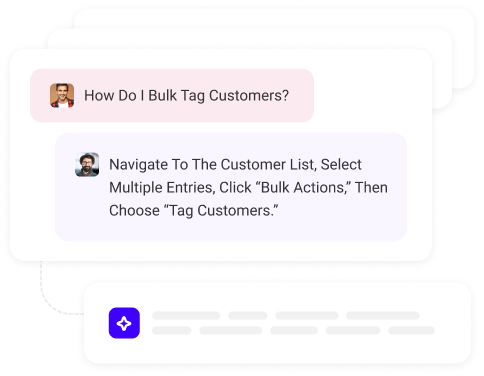

Deliver instant answers to customers

Easy to create

Understand customer needs

Organized and searchable

Beautifully branded

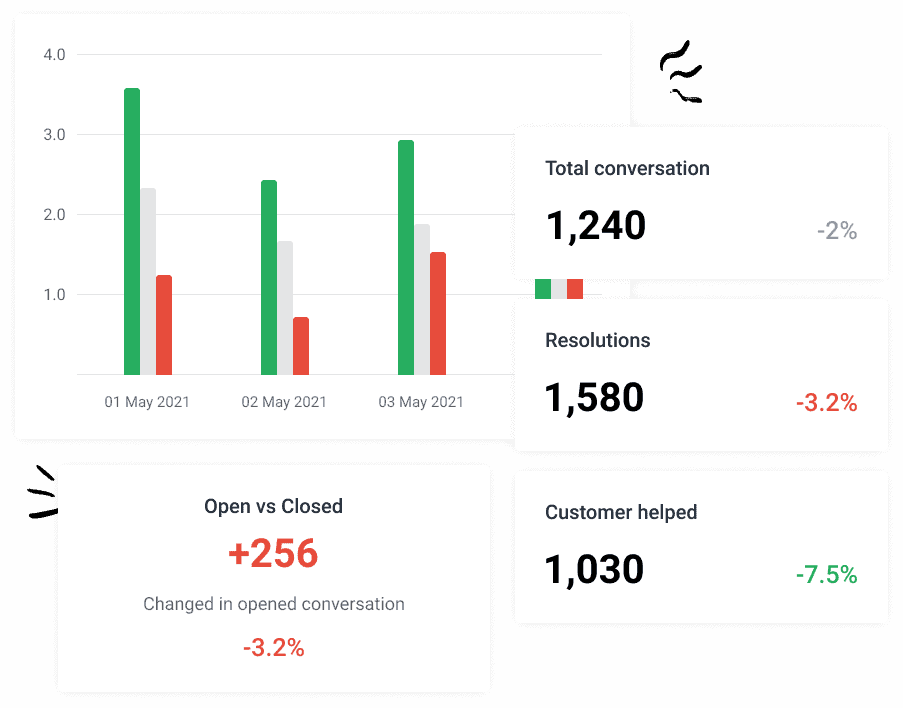

Metrics important for your company

Report on what matters

Track custom data points

Measure happiness

Know your agents

Enhancing team productivity

Automate your support

AI powered efficiency

Power of canned response

Keyboard shortcuts

Connect with your existing tech stack

The Most Powerful Customer Support Platform…Without High Cost 👍

Adblock detected!

Basic

- 2 Mailbox

- 4 seats included

- 3 Chatbots

- 5000 One-time AI credit

- 20 Links to train AI

- Live chat

- Internal notes with @mentions

- Helpdesk features

- Integrations

Standard

- 3 Mailbox

- 6 seats included

- 6 Chatbots

- 1 Knowledge Base

- 10,000 One-time AI credit

- 50 Links to train AI

- Live chat

- Powerups

- Helpdesk features

- AI features

Unlimited

- 4 Mailbox

- 10 seats included

- 10 Chatbots

- 1 Knowledge Base

- 20,000 One-time AI credit

- 100 Links to train AI

- Live chat

- Helpdesk features

- API & Webhook

- WP Portal

- WooCommerce, SureCart Integration

- Whitelabel Assistant

All plans include these amazing features

- Unlimited Emails

- Unlimited Live Chat

- Brandable Chat widget

- Internal notes and @mentions

- Instant Replies

- Email, In-app, Browser notificaitons

- Multilingual support

- Mobile application

- Email, Chat and Discord support

- Lifetime software updates

- 14 day money back guarantee

- Access to ThriveDesk academy

Our 100% No-Risk Money Back Guarantee!

We’re excited to have you experience ThriveDesk. Over the next 30 days, if ThriveDesk isn’t the best fit, simply reach out!

We’ll happily refund 100% of your money. No questions asked.

Thanks,

Parvez Akther

Founder, ThriveDesk

The answer is YES!

With ThriveDesk the answer is absolutely YES!

- Can I connect Gmail, Outlook, Hey or my custom email?

- Can our clients respond to our questions via email?

- Can I provide live chat support from my website?

- Can I add chatbot to my live chat assistant?

- Can I whitelabel the chatbot?

- Can I add chat assistant to any website platform?

- Can I customize the live chat widget?

- Can I train AI agent with my website content?

- Can I set AI agent to auto reply or draft response?

- Can I handle ticket and assign them to team member?

- Can Can I automate the support workflow?

- Can I use canned reply/macor to speed up reply?

- Can AI help me reply or polish my reply?

- Can I @mention someone so they're notified about something?

- Can I integrate my fav app with ThriveDesk?

- Can I assign ticket and live chat to multiple people?

- Can I filter tickets and live chat with tags?

- Can I create custom view with different filters?

- Can I create knowledge base to self help client?

- Can I host knowledge base on my own domain?

- Can ThriveDesk tell me which team member performing bad?

- Can ThriveDesk help to resolve customer query faster?

- Can ThriveDesk tell me client satisfaction rate?

- Can I search tickets and filter them?

- Can I connect my WooCommrece store for realtime customer insight?

- Can I use chatbot on my Shopify website?

Have more questions?

We've answer too...

I have questions about your company…

How long have you been around? Can we trust you?

ThriveDesk started in 2021 and stayed in beta until 2023. We began charging customers only after we knew the product was solid and ready.

But our story didn’t begin there. Our team has been building software since 2010 under the company ThemeXpert. Over the years, we’ve launched products used by thousands of businesses around the world.

We’ve stayed bootstrapped by choice. That means no outside investors pushing us to chase growth at any cost. We answer only to our customers.

We take our promises seriously. You won’t find a trail of broken commitments or angry reviews because we only ship what we can stand behind. Trust is built by showing up and delivering, and that’s what we’ve done for over a decade.

What about reliability and uptime?

Promises are easy to make. What matters are the numbers behind them.

Our track record speaks for itself. Over the years, our uptime has stayed above 99.99%. That means your inbox, chat, and helpdesk stay available when you need them.

We don’t hide our performance behind marketing claims. You can check our real-time status anytime on our Status Page.

What’s your refund policy like?

We keep it simple and fair. If ThriveDesk isn’t the right fit for you, we offer a full refund within 14 days—no questions asked.

We believe good business is built on trust, not fine print. If you’re not happy, we don’t want to keep your money. That’s how we’d want to be treated, and that’s how we treat our customers.

Can I ask ownership a question directly?

es, absolutely. You can reach our Co-Founder and CEO, Parvez Akther, at parvez@thrivedesk.com, and our Co-Founder and CTO, Abu Huraira, at ahba@themexpert.com.

They read and reply to their own emails. No assistants. No filters. If you have a question, concern, or idea, you’ll hear from them directly. That’s how we keep ThriveDesk human and accountable.

I have questions about security and our data…

How secure is ThriveDesk?

Security isn’t an afterthought for us. It’s something we build into every part of the product and our company.

We protect data through strict encryption, secure infrastructure, and continuous monitoring. Every detail of our approach is explained in our full security write-up at thrivedesk.com/our/security.

We know you’re trusting us with your business and your customers. That trust means everything, so we treat your data with the same care we treat our own.

Is our data backed up? How often?

Yes, your data is backed up multiple times every day. We store it across several redundant data centers to keep it safe from hardware failures or outages.

Backups are kept both locally and off-site, so even if one location goes down, your data remains secure and accessible. Files you upload are also stored off-site and mirrored in a different geographic region.

In short, your data isn’t sitting in one place. It’s protected, duplicated, and constantly monitored to make sure it’s always there when you need it.

Where are the servers that store our data?

Our servers are located in several secure data centers across the United States. These facilities are managed by top-tier providers with strong physical and digital safeguards.

From there, we serve customers in more than 160 countries. The setup ensures fast performance, reliable uptime, and the kind of protection your business deserves no matter where you operate.

Can I export our data if we ever want to leave?

Yes, absolutely. Your data is yours, and you can export it anytime you want.

If you decide to move on, just send us an email and we’ll prepare a complete export for you. No hidden steps, no friction. We believe in earning your business every day, not locking you in.

I have other questions…

Can I bring my own key(BYOK)?

Yes, you can. ThriveDesk includes GPT-4o and 4.1 models by default, which are powerful enough for most use cases.

If you want to use other OpenAI models, you can bring your own API key. We encrypt your key and use it only for API calls. It’s never stored in plain text or shared with anyone. Your data and your key remain fully under your control.

How AI credit works and how much it cost?

Every time AI performs an action—like drafting a ticket reply, labeling or prioritizing a conversation, or responding to a live chat—it uses a small amount of credit.

Different actions consume different amounts. Some use 1 credit, while others may use 2 to 4 depending on complexity.

We designed the system to be simple and transparent. You always know how your credits are being spent. You can find the full breakdown here: How AI credits work.

Does ThriveDesk provide whitelabeling?

Yes. When you connect your branded email, all replies to your customers go out under your own domain. Your customers see your brand, not ours.

ThriveDesk branding appears only on the Assistant and Knowledge Base footer. If you’re on the Unlimited plan, you can remove that branding entirely—or keep it with your affiliate link to earn extra revenue.

We built ThriveDesk to support your brand, not compete with it.

Does ThriveDesk have an API? Can we integrate with ThriveDesk?

Yes, ThriveDesk has a full-featured API that lets you build custom integrations, automate workflows, or connect with your own internal tools.

You can find all the technical details and endpoints in our API documentation. It’s straightforward, well-documented, and ready to use.

What’s your customer support like? What if we need help?

Our support team is made up of specialists who know ThriveDesk inside and out. Many of them have been with us for years, building and improving the very tools you use.

When you reach out, you’re not talking to a call center. You’re talking to people who actually build the product.

And for instant help, our NEO AI agent is available 24/7. It’s trained on our entire knowledge base and features, ready to guide you any time, day or night.

Is ThriveDesk available in languages other than English?

Yes. The ThriveDesk interface currently supports the languages shown in the image: English (US), Deutsch (DE), Português (BR), Française (FR), Español (ES), and Türkçe (TR).

Beyond that, all text strings in the Assistant and Knowledge Base are fully translatable. You can localize them into any language you need, so your customers can get support in the language they understand best.

If we go with ThriveDesk, will we still need stuff like Chatbase? Intercom? Document360?

No, you won’t. ThriveDesk brings all of those tools together in one place.

You get live chat with a built-in AI agent, so there’s no need for Chatbase. You get a complete ticketing system with automation and productivity tools, replacing Intercom. And you can create and manage your entire Knowledge Base right inside ThriveDesk, removing the need for Document360.

Still want to keep using those tools? No problem. You can connect them directly through our integration feature. ThriveDesk gives you the freedom to simplify—or expand—however you choose.

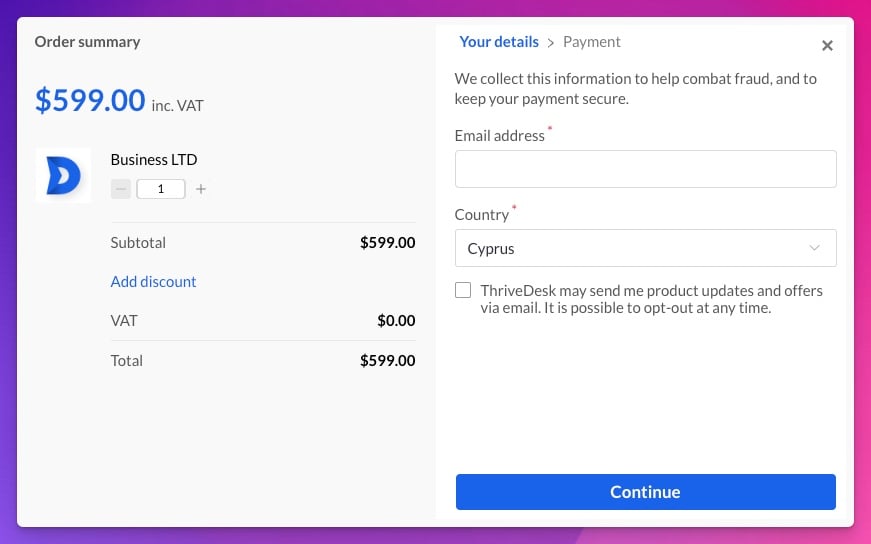

Information for Businesses and EU VAT

Subscribing as a company

After clicking the Buy button on our site you are taken to the payment page managed by our reseller, Paddle. The first page lets you enter (or verify) your email address and country:

Even though you see VAT being applied, click on Continue.

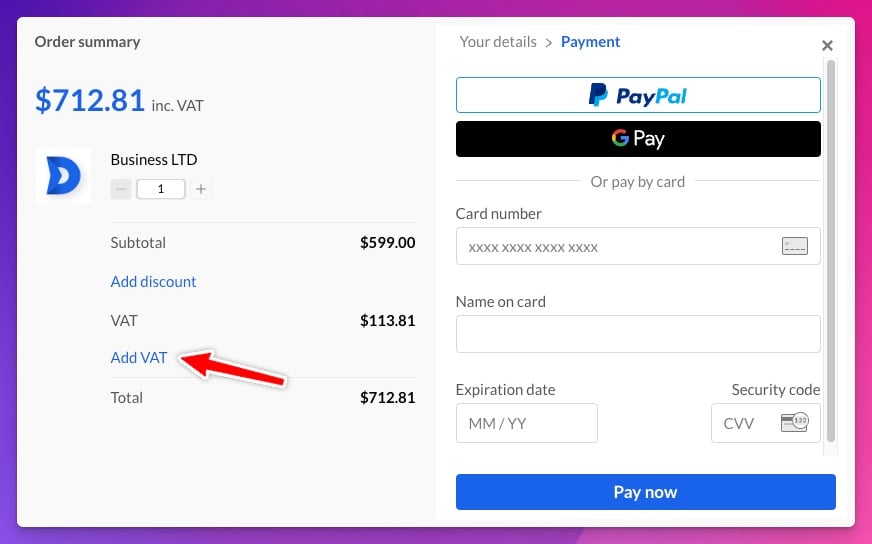

In the next page, look at the left hand side:

If you are an EU company click on the “+ Add VAT” link on the left hand side to enter your invoicing information, including your VAT number without the two-letter country prefix. You will see that no VAT is being charged.

If you entered a VAT number and VAT is still charged please check your VAT number with the EU VIES service:

- If the service reports the VAT number as invalid you can proceed without entering your business information at this step; after subscribing you will need to follow the instructions under “Converting your receipt to an invoice” below.

- If the service reports a temporary problem with the member state’s database you can proceed with your payment without entering your business information and follow the instructions under “Requesting a VAT refund” below after a day or two. You will be refunded the VAT and your receipt will be converted to an invoice.

If you a non-EU company the “+ Add VAT” link does not appear. Instead, proceed with the payment and follow the instructions below, under “Converting your receipt to an invoice”. Please note that sales tax may be added if applicable.

Good to know: Paddle is the Merchant of Record, meaning that you are paying Paddle, therefore the invoice is issued by Paddle, not ThriveDesk. Kindly note that Paddle is based in the United Kingdom. All UK businesses will be charged the applicable VAT regardless of whether they enter a valid VAT number, in accordance to local tax laws.

What is a Shared Inbox? Why should we have one?

A Shared Inbox is a special kind of Inbox that lets multiple team members handle emails that come into one Inbox without any problems.

- Team collaboration: Private internal notes, @mentions, and collision detection prevent team members from working on the same conversation simultaneously.

- Conversation History: Easily see the full audit trail on a conversation of who has worked on it and what has happened on it.

- Reporting: makes it simple to keep tabs on both the individual and collective performance of your team.

- Powerful Search: With a powerful search query builder, you can find anything and everything with a few clicks.

How is ThriveDesk different from sharing a Gmail login?

There are no team-oriented features in Gmail because it was designed to be used by only one person. As part of the ThriveDesk platform, you’ll be able to take advantage of sophisticated collaboration features such as private notes, @mentions, and collision detection.

In addition, we have a bunch of handy features like conversation states, canned reply, powerful reporting and customer information widgets that contain full customer purchase history.

Does ThriveDesk allow us to support multiple brands?

Yes. You can forward in multiple email addresses and each will have its mailbox in ThriveDesk. Your team can see and respond as desired for each brand/store. You can also have multiple assistants, chats, knowledge bases, communities, etc. Each is customized with your branding.

How long does it take to set up our account? Can you help?

As soon as you sign up, our onboarding workflow guides you through the process of setting up your mailbox and adding your team members in just a few clicks.

Please don’t hesitate to get in touch with our support team if you have any questions or concerns about how to set up your account.

Can I delete my data and account?

Yes, from your account settings you can delete your account and we’ll remove everything instantly. You’ve the complete right to be forgotten.

What payment methods do you accept?

We accept payments from PayPal, MasterCard, Visa, American Express, and all major credit & debit cards.

Converting your receipt to an invoice

Paddle emails you with a payment receipt upon successful payment. This receipt is a valid tax invoice if you had already entered your invoicing information before payment.

If you did not enter your company’s invoicing information during payment for any reason you can do so within 7 days of the receipt having been issued. Follow the link in the email you received from Paddle to open the receipt in your browser. If you deleted this email you can still find that link after logging into our site, under Billing > Invoices.

The left hand side of the receipt page has a blue link to enter your invoicing information. Click on it and enter your company information. This is enough to convert the receipt to a valid tax invoice. You can print that page, either to a piece of paper or a PDF file, and file it as a business expense.

If the link does not appear it may be the case that the receipt has been issued more than 7 days ago. In this case please contact Paddle as noted further above

Requesting a VAT refund (European Union clients only)

If you forgot to enter your VAT number or the VAT number validation did not work at the time, please follow the “Converting your receipt to an invoice” instructions above. While doing that you will enter your VAT number. A VAT refund will be issued in the next few days.

According to our experience the invoice is not amended to show that no VAT was actually charged. If your tax jurisdiction does not allow that, please contact Paddle at help@paddle.com and do remember to include your invoice number.

We Are Proud of Our Amazing Team.😍

Say Hello to Gen AI Customer Support